For business owners in the state of Florida, there are numerous advantages to operating in a state...

Sinkhole Coverage: Protect Your Property from Florida's Subterranean Threat

Sinkholes are a geological phenomenon that can wreak havoc on properties. These ground collapses can cause extensive and costly damage, leaving homeowners and business owners concerned about their financial security.

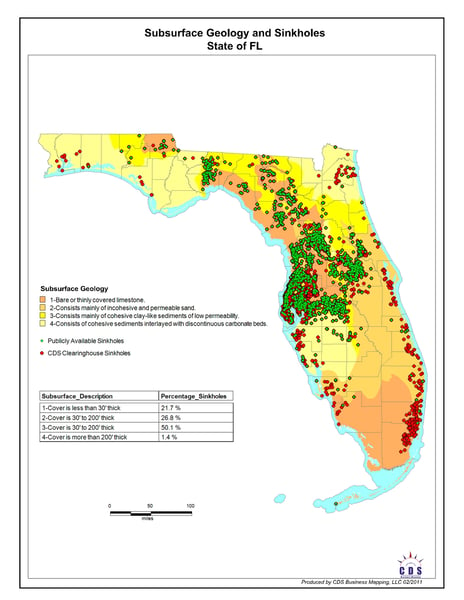

Florida is particularly prone to sinkholes due to its geological makeup. The state sits on a foundation of limestone, which is highly susceptible to dissolution by acidic groundwater over time. As the limestone dissolves, it can create underground cavities, and when the ground above these cavities becomes too heavy or saturated with water, it may collapse, resulting in a sinkhole.

Sinkhole Coverage: A Brief Overview

Sinkhole coverage, also known as "catastrophic ground cover collapse insurance," is specifically designed to protect property owners from the financial consequences of sinkhole-related damage. In Florida, where the geology and weather patterns make sinkholes more prevalent, this coverage can be a financial lifesaver.

For Residence Owners:

Sinkhole coverage is an essential consideration for homeowners in Florida. Sinkholes can suddenly appear and cause structural damage to your home, leading to expensive repairs. Standard homeowners' insurance policies may not automatically include coverage for sinkhole damage, or they may provide only limited protection. For peace of mind, homeowners should explore standalone sinkhole insurance or sinkhole endorsements to their existing policies. This additional coverage ensures that your investment is protected against the costly aftermath of a sinkhole event.

For Business Owners:

Business owners in Florida also need to be vigilant about sinkhole damage. A sinkhole on your business property can disrupt your operations, damage inventory, and incur significant repair costs. While commercial property insurance may cover some types of structural damage, it's crucial to determine whether sinkholes are included. Business owners should consider sinkhole coverage as an endorsement to their commercial property insurance policy or as a separate policy. This additional safeguard helps prevent financial setbacks, ensuring that your business can continue to thrive, even in the face of this geological threat.

Sinkhole coverage is not just a safety net; it's a financial shield against a unique Florida hazard. Residence and business owners should carefully assess their existing insurance policies, looking into the specifics of sinkhole coverage. Whether added as an endorsement or a separate policy, it provides peace of mind and financial protection against the unpredictable forces of nature. In Florida, where sinkholes can cause significant damage, this coverage is more than a consideration – it's a necessary step towards securing your property and livelihood.